What Authors Can Learn From Accountants and Payroll Managers

Scribes would do well to take a page from these folks' books.

Accountants and payroll professionals worth their salt may come off as rigid, meticulous, and excessively detail-oriented in the workplace. You might even use the word prosaic.

To that, I say, "Good." These traits are occupational features, not bugs. The last thing you want is a big-picture, overly, er, creative person responsible for overseeing your organization's bank accounts or accounts receivable department. Let the chief marketing officer think about pie-in-the-sky ideas. "I don't care if I get paid on Friday," said no employee or vendor ever.

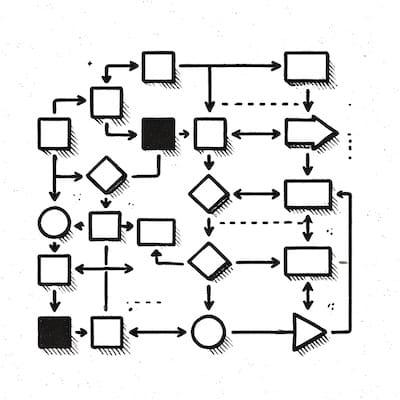

Not coincidentally, numbers-oriented folks tend to strictly abide by their organizations' internal processes—or quickly find themselves switching careers or employers. To wit, the accountant who closes the firm's quarterly or annual books a few days too early risks filing inaccurate state and federal financial reports. In a publicly traded company, the CFO may be headed to the clink. The payroll manager who calculates employee taxes without first figuring out overtime will earn the ire of workers, union officials, and finance folks. Make no mistake: Order matters. Big time.